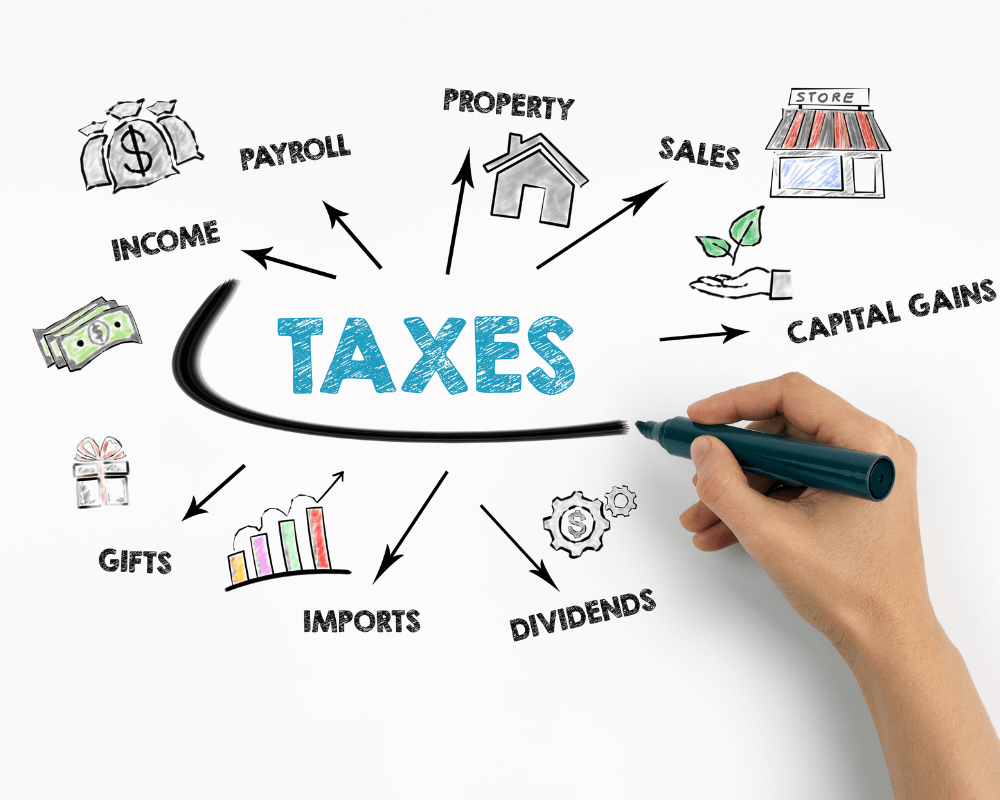

Common Tax Mistakes to Avoid

How to avoid costly mistakes As a business owner, it is important to have a clear understanding of tax laws and regulations in order to avoid costly mistakes. In this blog post, we will discuss some common tax mistakes that business owners should be aware of and provide tips on how to avoid them. Failing […]

Tips for Preparing Financial Statements

How to effectively prepare financial statements Preparing financial statements is an essential part of running a successful business. These statements provide a detailed overview of a company’s financial health, including its revenues, expenses, assets, and liabilities. In this blog, we’ll go over some tips for preparing financial statements that will help you make better business […]

How to Find an Accountant Near Me

Tips for finding an Accountant near you How do I find an accountant near me? Having a reliable accountant by your side is crucial for effective financial management and compliance with tax regulations. While technology has made it easier to connect with professionals remotely, many individuals and businesses prefer the convenience of working with an […]

Tax Planning Strategies for SMEs

What are some key tax planning strategies for SMEs? As a small or medium-sized enterprise (SME) owner, you understand the significance of tax planning in optimising your business’s financial health. Effective tax planning can help you minimise your tax liabilities and maximise savings, allowing you to reinvest in your business’s growth and success. In this […]

Tax Deductions for Businesses

Understanding the available tax deductions for businesses Tax deductions are a valuable tool for businesses to minimise tax liabilities and maximise savings. By taking advantage of available tax deductions, businesses can optimise their financial resources and reinvest in growth initiatives. In this blog, we will explore the importance of tax deductions and provide insights on […]

Best Accounting Services for Small Businesses

What are the best accounting services for SMEs? Small businesses face unique financial challenges that require expert accounting services to overcome. From managing cash flow to ensuring tax compliance, having a reliable accounting partner is crucial. In this blog post, we will highlight the best accounting services available for small businesses in the UK, providing […]

How to Manage Cash Flow for Your Business

What can businesses do to manage their cash flow effectively? Managing cash flow is essential for any business, big or small. Cash flow refers to the amount of money coming in and the amount going out of your business, and it’s important to keep track of this to ensure your business stays afloat. In this […]

Financial Advice for Business Owners

Should I receive additional financial advice for my business? It depends on your specific financial needs and goals for your business. An accountant can provide a wide range of financial services, including help with tax planning, bookkeeping, and financial forecasting. They can also advise on funding options and assist with the preparation of financial statements. […]

Tax Compliance for Businesses

How to maintain tax compliance within your business Maintaining tax compliance is crucial for businesses to avoid penalties, legal issues, and reputational damage. As a business, understanding and fulfilling your tax obligations is essential for smooth financial operations. In this blog, we will provide essential tips to help businesses stay tax compliant and navigate the […]

The Importance of Bookkeeping for Small Businesses

Why is Bookkeeping important for SMEs? Small business owners have a lot on their plate. From managing employees to marketing their products or services, there never seems to be enough time in the day. One area that often gets overlooked is bookkeeping. Bookkeeping is the process of recording financial transactions and keeping accurate financial records. […]